Business Rates Review: technical consultation

Updated 15 March 2023

Applies to England

Scope of the consultation

Topic of this consultation

This consultation sets out how the government intends to give effect to a number of measures arising from its recent business rates review. It covers the following areas:

- Measures to enable more frequent revaluations

- Improvement relief

- Support for investment in green plant and machinery

- Other administrative changes

Geographical scope

These proposals relate to England only.

Impact assessment

No impact assessment is required for this consultation.

Basic information

Body/bodies responsible for the consultation

Department for Levelling Up, Housing and Communities; HM Treasury.

Duration

This consultation will last for 12 weeks, from 30 November 2021 to 22 February 2022.

Enquiries

For any enquiries about the consultation please contact: ndr@communities.gov.uk.

How to respond

You may respond by completing an online survey.

Alternatively you can email your response to the questions in this consultation to ndr@communities.gov.uk.

If you are responding in writing, please make it clear which questions you are responding to.

Written responses should be sent to: ndr@communities.gov.uk

When you reply it would be very useful if you confirm whether you are replying as an individual or submitting an official response on behalf of an organisation and include:

- your name

- your position (if applicable)

- the name of organisation (if applicable)

- an address (including postcode)

- an email address

- a contact telephone number

Executive summary

At the 2021 Autumn Budget, the government concluded its review of the business rates system. The government announced new support for businesses to help our high streets and town centres evolve and adapt to changing consumer demands ahead of the next revaluation; new support for investment in green technology and property improvements; changes to support more frequent revaluations; a further freeze in the business rates multiplier; and significant investment in the Valuation Office Agency (VOA).

The review announced several changes to reduce the burden of business rates by £7 billion over the next 5 years through: a new temporary relief for eligible retail, hospitality, and leisure properties; freezing the multiplier in 2022 to 2023; introducing support for investment in green Plant and Machinery (P&M); introduction of a new improvement relief; and extensions to the Supporting Small Business and Transitional Relief Schemes.

The review also set out the government’s plans to meaningfully improve the operation of the system by moving to 3-yearly revaluations from 2023 and set out a plan for getting there, including by providing £0.5 billion for the VOA as part of the Spending Review, and additional funding for the new reform measures supporting the move to a more frequent revaluations cycle.

These changes follow over £16 billion of support provided through the business rates system during the pandemic, and will help to cut the burden of business rates and ensure that the system works well for all ratepayers.

As set out in the final report, the government is now seeking to consult on the technical detail of the proposed changes. This technical consultation sets out in further detail how the government intends to give effect to a number of the announced policy changes and seeks the engagement that will be critical to ensuring that subsequent legislation is fit for purpose.

More frequent revaluations

Responses to the government’s earlier call for evidence highlighted that there was a strong desire for a system of more frequent revaluations to better reflect changes in the underlying property market, and respond to economic changes in a timelier fashion.

The government’s consultation on more frequent revaluations (MFR) in summer 2021 set out a range of reforms being considered by the government to support a sustainable 3-yearly revaluation cycle and provide benefits to ratepayers, such as greater transparency on valuations, greater valuation accuracy, and a better appeals process.

The final report set out the government’s conclusion with regard to the various changes set out in the earlier consultation. These conclusions are addressed in subsequent chapters below:

- Chapter 1 – information provision

- Chapter 2 – the supporting compliance regime

- Chapter 3 – appeals changes and transparency

This technical consultation sets out in more detail how the government envisages the proposed changes working in practice. It is the government’s objective to enable sustainable 3-yearly revaluations through changes which are proportionate and minimise the burden on business.

To help ensure the sustainability of a more frequent revaluations cycle, businesses will need to provide information relevant to their valuation – such as changes in lease agreements or new improvements to their property – to the VOA.

Without these reforms, the VOA would not be able to deliver a full revaluations cycle, and clear all appeals against the lists, within a 3-yearly cycle. Provision of this information, alongside the additional funding for the VOA provided at the Spending Review, will be key to enabling a 3-yearly cycle, because it will ensure that VOA has more accurate and comprehensive information about properties and market rents, so that it can more quickly update valuations. This will also increase the quantity and quality of evidence used to derive valuations, which will improve valuation accuracy, benefitting ratepayers by reducing the need to challenge their valuation.

In addition, as noted in the final report of the Business Rates Review, the government considers that these reforms will also be crucial to ultimately going further – for example, by shortening the Antecedent Valuation Date (AVD), which, whilst not being pursued at this stage, remains an aspiration.

Government recognises that providing information to the VOA places a new requirement on firms, but is committed to minimising the impact and cost of doing so as far as possible. For a significant number of ratepayers, where there have been no changes in a given year, it will be quick and easy to fill out the new annual confirmation. Where the VOA is aware of changes that have happened, reminders will be issued, to support ratepayers to meet their obligations. The government will also seek to minimize instances where ratepayers may be asked to provide the same or similar information to local or central government more than once. The proposed approach to this new process is set out in detail below.

As set out in the final report, the government considers that the reforms designed to support a 3-yearly cycle will be crucial to ultimately go further in shortening the Antecedent Valuation Date (AVD), which, whilst not being pursued at this stage, remains an aspiration.

Improvement Relief (chapter 4)

The final report set out the government’s intention to bring forward a new relief for eligible improvement works, from April 2023, to support businesses that want to invest in their premises to make them more efficient and work better for employees and customers. This responds to a key ask from businesses, including the Confederation of British Industry, the British Retail Consortium, the Federation of Small Businesses and the British Chambers of Commerce.

The new relief reduces the cost to businesses investing in their premises as they grow, enabling them to adapt to meet rising demand and enhance productivity. The relief will also allow businesses to make improvements to their premises that support a transition to net zero and enhance employee wellbeing by upgrading the physical work environment.

This consultation sets out further detail on qualifying types of improvements, conditions around occupancy and who will be eligible for relief, as well as how the relief will be administered and interact with other reliefs.

Support for investment in green plant and machinery (chapter 5)

The Business Rates Review also announced new measures to support business investment in green technology and the decarbonisation of non-domestic buildings. This responds to a key ask from businesses in the call for evidence, with over 40% of respondents calling for exemptions for various forms of green energy generation including the Confederation of British Industry, the Federation of Small Businesses and the British Property Federation.

From April 2023, the government will introduce an exemption for eligible plant and machinery used in onsite renewable energy generation and storage, and a 100% relief for eligible low-carbon heat networks that have their own rates bill.

This consultation sets out further detail on the specific technologies in scope of the proposed exemption and the criteria for the relief for heat networks.

Other changes (chapter 6)

Finally, the review also set out that the government would bring forward changes to improve the operation of the central rating list, and the rules under which local authorities may award Small Business Rates Relief and other discretionary rate relief.

These changes will ensure that the system better reflects the discretion available to local authorities and is more capable of reacting to the prevailing business rates landscape.

Next steps

As above, this technical consultation explains and seeks views on how the government proposes to implement these measures. The government is not seeking views on the conclusions of the business rates review or the contents of the final report. The scope of the consultation does not, therefore, extend to whether the measures announced in the business rates review should be extended or adapted. The consultation will be used to inform implementation of these measures including changes to legislation. We welcome detailed and thorough engagement with this technical consultation process.

As set out in the final report, the government intends to consult on a number of other changes in due course:

- The government expects to consult on Digitalising Business Rates next year. This programme will enable HMRC to develop a versatile database for matching business rates data with central HMRC tax data. We are also reviewing what powers are needed to underpin the data collection and transfers to enable this, and the formulation and timing of any necessary legislation.

- The government will continue to consider the arguments for and against an Online Sales Tax which, if introduced, would raise revenue to fund business rates reductions. The Online Sales Tax consultation will follow in due course.

- Further consultation is expected on avoidance and evasion in relation to business rates reliefs in 2022.

Chapter 1: Provision of information

Introduction

1.1 Moving to a more frequent revaluations cycle represents a fundamental improvement in the business rates system, ensuring that ratepayers see their valuations updated more quickly to reflect changing economic conditions. This will make the business rates system more agile and responsive to change. It will also help to ensure greater distributional fairness, by redistributing the burden of business rates more frequently between ratepayers.

1.2 This chapter describes the new legal duty to be established requiring ratepayers to supply certain types of information to the VOA, in order to support more frequent revaluations and improve the accuracy of rating lists. Responses to the call for evidence in 2020 and the consultation on more frequent revaluations in summer 2021 indicated general support for greater provision of information in exchange for increased transparency and as a necessary step to reach more frequent revaluations.

1.3 The government considers that improving the accuracy of rating lists will strengthen the fundamental soundness of the system, ensuring that valuations are assessed using better and more timely evidence, and reducing the need for ratepayers to submit Challenges. Improving the accuracy of lists will also help ensure the right ratepayers pay the right tax, bring business rates more into line with other taxes, and improve the ability of local authorities to conduct sound financial planning.

1.4 Nevertheless, the government is aware that this represents a significant shift in how ratepayers engage with the VOA, and is therefore keen to ensure that it is implemented in a way that is straightforward, fair, and easy to comply with. We also want to ensure that our approach accommodates the needs of businesses with large property portfolios, those who opt to engage with the process using an agent, as well as individual customers with a single property who may have little experience of engaging with the VOA.

1.5 This chapter explains how and when this new process will apply. Chapter 2 explains how we will support ratepayers to meet their obligations.

Background

1.6 The VOA has a statutory obligation to compile and maintain non-domestic rating lists, and requires access to certain types of property, rental and accounts data to conduct effective valuations. Currently there is no mandated requirement for ratepayers to notify either the VOA or billing authorities about changes to this information even where it may have an impact on their business rates valuation, which means that rating lists are not as accurate as they could be and puts the business rates system at odds with the majority of other taxes. In practice, this can mean occupiers of similar properties not being taxed equally and local authorities not receiving the correct amount of tax.

1.7 Many ratepayers already provide information when asked by the VOA or billing authorities to ensure their bills are correct. Introducing a new information provision requirement will ensure fairness across ratepayers, and provide valuation officers with the necessary information to compile and maintain accurate lists in a shortened cycle.

1.8 With an element of ratepayer self-declaration in place, the VOA will be able to base their valuations on a more comprehensive and up-to-date evidence base, leading to more reliable valuations, and greater confidence among ratepayers that they will be paying tax based on the right property details. In the longer term, this should also reduce challenges against rateable values. Self-declaration will also mean changes are made closer to the actual change in the property, reducing the need for backdating of bills, thereby providing more certainty to ratepayers on the tax due.

1.9 To realise these benefits the government will introduce:

- a duty to notify the VOA of changes to the occupier and property characteristics that affect the assessment of the property for business rates. The VOA will share occupier details with billing authorities to support correct and timely business rates bills

- mandatory provision of rent and lease information, as well as trade information used for valuation

1.10 Alongside this, we will also be retaining existing powers (under Schedule 9(5) of the Local Government Finance Act 1988), which will primarily be used by the VOA to request cost information for properties valued on the contractor’s basis.

1.11 In order for information relating to valuation to be more up-to-date in real-time, the government proposes that people using rateable property will need to update the VOA each time circumstances change (such as when their rent changes, they start or stop occupying a property, or they alter a property); and confirm with VOA each April that they have made any relevant notifications and their information remains up to date.

1.12 This will ensure that the VOA will have more reliable and up to date information, which, as described above, is key to improving valuation accuracy and enabling the move to 3-yearly revaluations, as well as creating the potential to go further in the future. It will also allow the VOA to respond to changes closer to the actual event, reducing the need for backdating of bills, thereby providing more certainty to businesses and billing authorities. As information will need to be provided close to the event, usually within 30 days (see chapter 2), it is more likely to be readily available, reducing the need for ratepayers to go back through their records to retrieve the information. Updating the details held by the VOA at the point there is a notifiable change is also an essential requirement for the streamlining of CCA (see chapter 3).

1.13 We recognise how important it is for ratepayers to understand what information is needed and why. Only information that is relevant to the identification of ratepayers and valuation of properties for business rates will need to be provided. This will minimise the burden on ratepayers and ensure that the purpose of providing information is intrinsically connected to the valuation function of the VOA.

1.14 The new information to be provided concerns changes to occupier and property characteristics, and commercial and lease information, because these are essential elements of the VOA’s process for fairly and accurately determining rateable values. A property’s rateable value represents the rent the property could have been let for on a certain date set in law. To determine this rateable value, the VOA, in most instances, considers rental evidence (typically rent and lease agreements where these are available) from the property itself (where available) as well as from similar properties nearby. But to understand this rental evidence they also need to know the physical features of those properties so that the rents can be adjusted to a common value per unit of comparison (usually per square metre) reflecting each property’s individual features. This evidence is then used to value all similar properties in the locality. It is therefore important that the VOA has access both to rental evidence and to property and occupier details, to bolster the accuracy of the list and engender confidence in the valuation system.

1.15 The landscape of non-domestic properties eligible for rating is a diverse one, ranging from advertising rights to power stations, corner shops and schools. The information that the VOA requires from occupiers or owners to perform its valuation function varies by type, scale and use of properties. The government has taken this into consideration when designing the new system.

General approach to information provision

1.16 The government wishes to design a system which:

- is straightforward, easy to use, and adds minimal additional burden on ratepayers

- can be easily met by small businesses and is not punitive on those who may legitimately struggle to meet perfect compliance but also provides the right incentives for all businesses to comply

- allows lenience where appropriate for genuine errors, but focuses enforcement on those where intervention is most justified (such as those wilfully refusing to comply)

- is practicable and cost effective for ratepayers and the VOA

1.17 Having regard to these principles, the government is considering a general duty to provide information relevant to the identification and valuation of a rateable property. This means that in practice the requirements to provide property information and rental and commercial information will work as a single duty but tailored to the circumstances of each property and ratepayer. Adopting a general approach means that ratepayers will be expected to take simple steps to find out what information they need to provide.

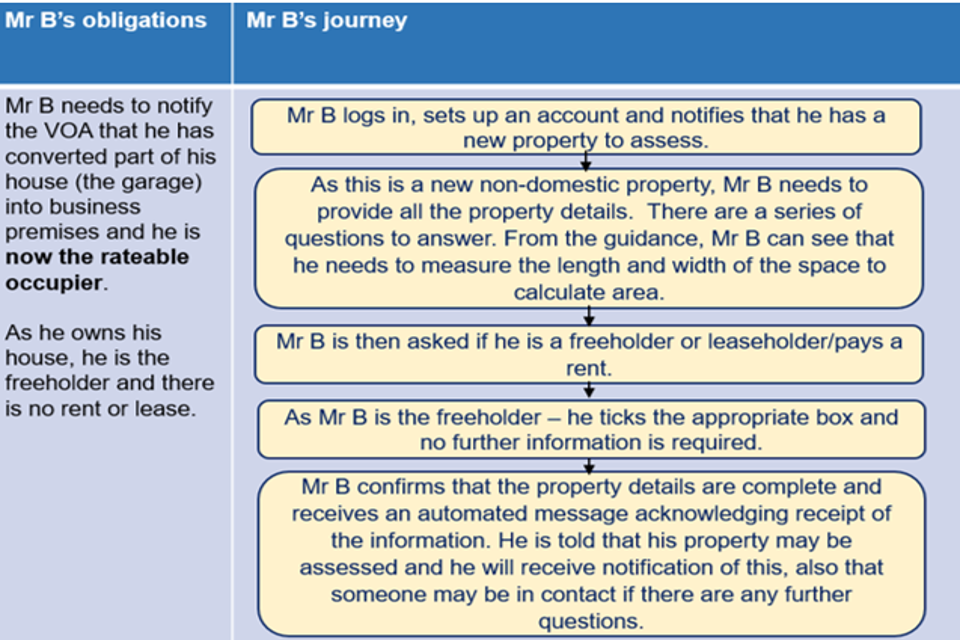

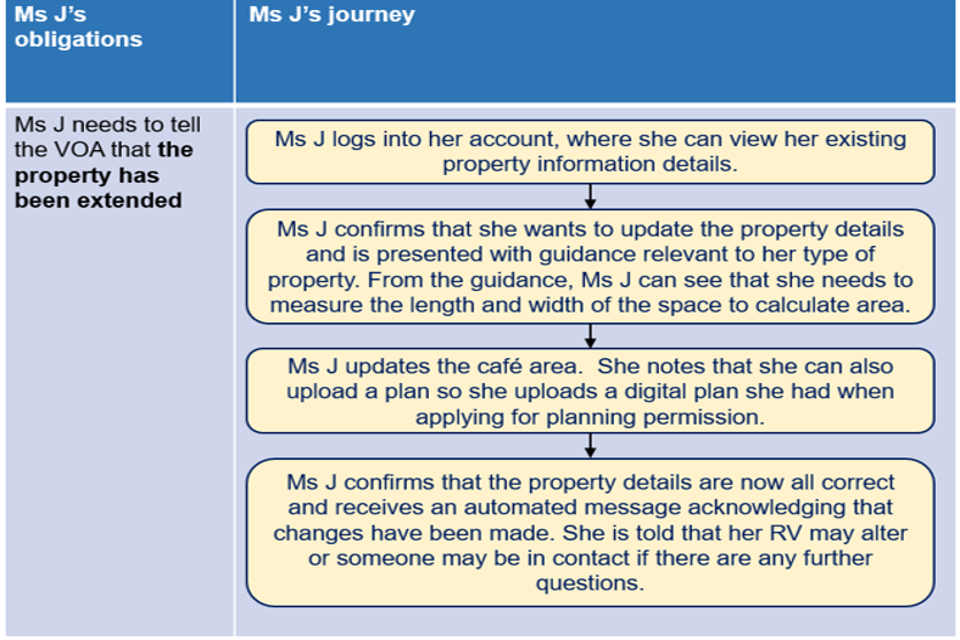

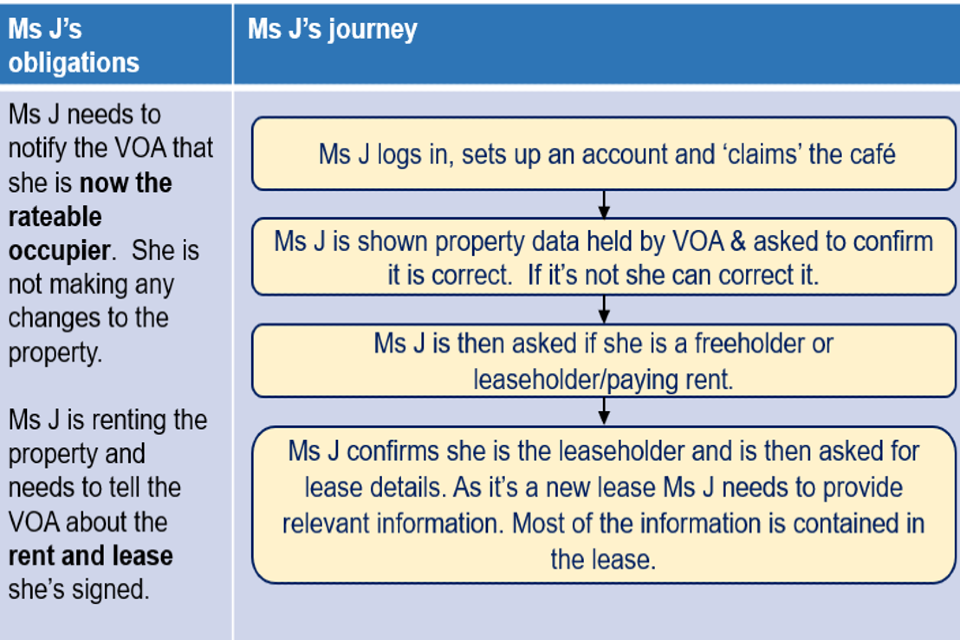

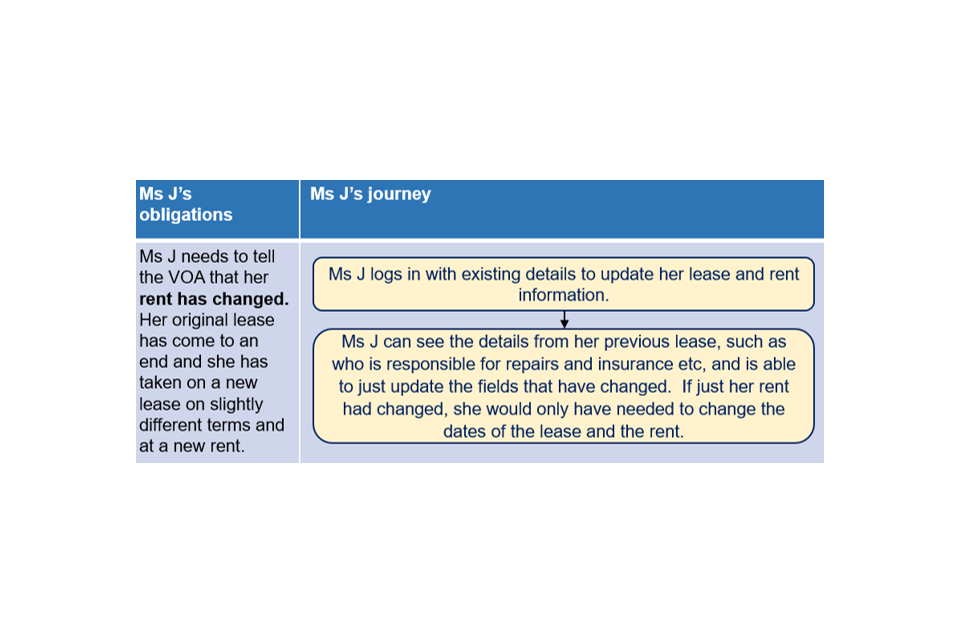

1.18 There will be clear, simple guidance on GOV.UK which will outline how ratepayers can easily understand what they need to provide, and signpost them to an online service where they can follow guided steps to ensure they are complying. Ratepayers will need to access and sign up to the online service and follow the instructions, in the same way as other tax obligations. For example, when a person starts trading, it is it is incumbent on them to find out what information they should provide to HMRC, for example by accessing Gov.uk guidance, and this will work in a similar way. The GOV.UK guidance and online service will support ratepayers to understand what specific information will be required and when, depending on the circumstances of the property. This approach will minimise the burden on ratepayers by ensuring they only need provide information that is relevant to their property and circumstances. The process will be designed to work for all businesses including those with large property portfolios, and also those who engage an agent to act on their behalf.

What information will be required

1.19 To inform the VOA in carrying out its valuation function, ratepayers will be required to provide:

- information about the property

- information about the tenancy and use of the property

- trade and accounts information (where relevant to the valuation)

- costs information (where relevant to the valuation)

Information about the property

1.20 Ratepayers will need to notify the VOA of any changes in relevant information about the property. For these purposes, relevant information is defined as information the VOA would need in order to identify the unit of property to be assessed for business rates (known as the “hereditament”) or assess its rateable value.

1.21 The amount and type of information required to identify the ratepayer and the hereditament and/or its extent will vary considerably by property. Nevertheless, it is likely to include details about the ratepayer (such as name and contact details), what property they have occupied and how it is being used. For unoccupied properties the VOA may need more information about the property, its intended use and how it is expected to be occupied. What is needed will vary considerably from property to property. For example, the VOA are likely to require quite detailed information about the arrangements at a shared office site before they can identify the individual units to be assessed for their own rates bills. The VOA may also need detailed information about the nature of the use of a concession at a shopping centre or airport and its licence conditions before deciding what is to be assessed, whereas very little may be needed from the new occupier of a standard industrial unit.

1.22 The information required to assess a property’s rateable value will also vary. Very specific information is needed for a telecom mast or advertising rights. The VOA would need to know the areas of an office but might need different information about a pub or petrol station. The VOA may also need to know how different parts of the property were being used as this may affect the valuation.

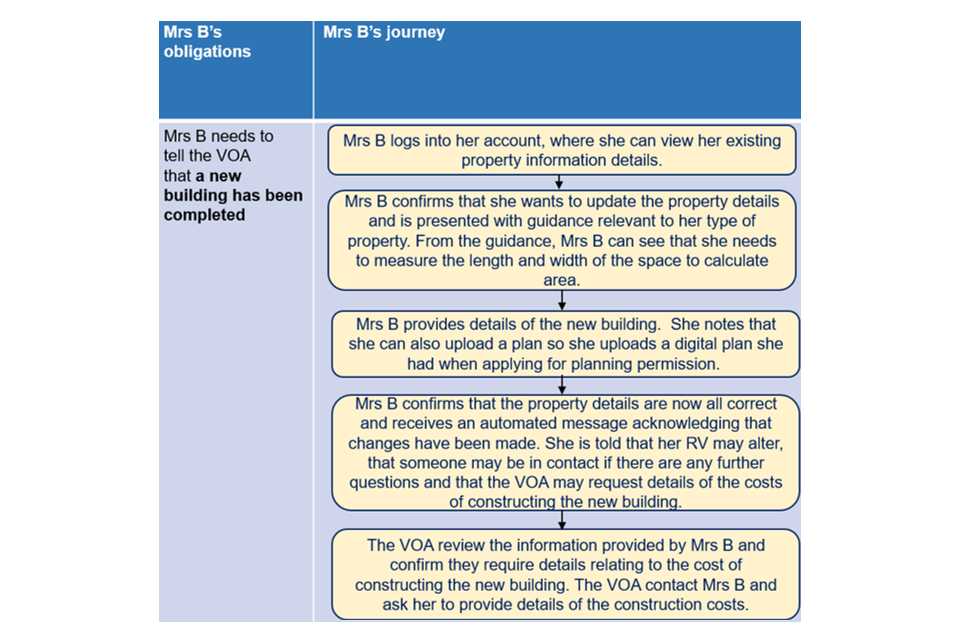

1.23 This will also apply to relevant information which has changed. For example, it would apply to the expanded part only of a recently extended property, but for a new property it would apply to all of its relevant details. Over time this will, therefore, feed to the VOA a more complete picture of relevant information on all properties to inform accurate valuations.

Information about the tenancy and use of the property

1.24 Ratepayers will need to notify the VOA of changes to relevant information about the lease(s), licence(s) or other agreements concerning the use of the property. The nature of information required overall will be the same as what is requested in the VOA’s current process for collecting information (known as “Forms of Return”). The ratepayer will be able to identify the relevant information specific to their property by simply accessing the online service.

1.25 Such information enables the VOA to undertake an accurate valuation of the property at hand, but also to assess the valuation of similar properties in the locality.

Trade and accounts information

1.26 A much smaller number, occupying certain specialised types of properties, may need to provide information about their trade and accounts (where it is relevant to their rateable value). This obligation may apply, for example, to utility networks, pubs and petrol filling stations. It will not apply to most ratepayers occupying shops, offices and factories. The type of information which the VOA will need is already provided through the VOA’s current process of collecting information (“Forms of Return”). These ratepayers are already familiar with the provision of such information. Unlike the other parts of the duty, this one will not be triggered by a change in relevant information but will have to be provided annually for a 12-month period. Ratepayers will be able to provide this information when completing their annual confirmation.

Annual confirmation

1.27 An annual confirmation stage will require ratepayers to access the online service annually to confirm that they have provided the information which is required of them and in the course of doing so will be asked to confirm that the data held for their property remains correct. This will give ratepayers who have failed to notify the VOA of changes during the year an opportunity to correct their information.

Application of the duty

1.28 In business rates, a unit of property which merits its own assessment on a rating list is called a ‘hereditament’. The duty will apply to the ratepayer of a hereditament, irrespective of whether that hereditament has yet been entered on to a rating list. This is either the person in rateable occupation of the hereditament or the person entitled to possession if the property is unoccupied. This will ensure that a leaseholder who has vacated but still retains the lease will still be captured by the duty rather than the freeholder. The duty will apply to hereditaments which are not yet in a rating list so that there is no information gap when a hereditament joins a rating list for the first time.

1.29 Property which is not a hereditament will not be captured by the duty. For example, a property under reconstruction may not be a hereditament at that time and will not fall under the duty. But owners of properties which have been served a completion notice prior to completion of works will be subject to the duty upon entering a list. The government recognises that it will not be obvious to the occupier of every property whether they are occupying a hereditament if they are not currently being assessed for business rates. Ratepayers will be able to access clear guidance on Gov.uk which will enable them to establish whether they need to enter the online service, which in turn will contain steps for determining whether a hereditament has come into existence.

1.30 Some hereditaments are exempt from business rates and these will be excluded from the duty while they are wholly exempt. Likewise, hereditaments which are wholly domestic will be excluded. For composite (where occupation is partly domestic and partly non-domestic) the duty will apply to the whole hereditament.

1.31 The government considers it appropriate and in line with other taxes for ratepayers to be expected to work out their obligations. However, we do not expect all ratepayers to acquire the knowledge needed to know what is relevant to the VOA’s work. In practice, all a ratepayer will need to do is access and sign up to the VOA’s online service, which will be signposted on Gov.uk. The information required is relevant information which the ratepayer could reasonably be expected to know should they have taken reasonable steps to find out. Once the ratepayer has taken reasonable steps to find out whether the duty applies to them by accessing the online service, the VOA will ensure that ratepayers are made aware of their obligations through a series of simple questions and steps. Therefore, in practice all ratepayers will need to do in order to satisfy their obligations is visit Gov.uk, use the online service and answer all the questions asked of them.

Consultation questions – Chapter 1

Q1. Do you have any views on the proposed implementation of the information provision system? What issues should be considered in the design of the new system?

Q2. Can you see any difficulties in collecting this information or providing it to the VOA? Is there any further information that should be provided?

Q3. How can the VOA best help customers understand what is needed and how to provide it?

Q4. How do you want to be engaged with as this system is developed?

Chapter 2: Supporting ratepayers to meet their obligations

Introduction

2.1 The new system for provision of information set out in chapter 1 will support more frequent revaluations, as well as more accurate rating lists, ensuring a fairer system and reducing the need for challenges. Alongside this, the government will introduce a proportionate compliance regime, to support ratepayers to meet their obligations.

2.2 In designing the regime, a number of current tax compliance regimes have been considered, as well as those which are being implemented in the future. The proposed approach is based on well-established regimes that work and, we consider, strike the right balance between providing appropriate support to ratepayers to help them get it right, while deterring and penalising those who deliberately or persistently fail to provide the right information.

2.3 It is expected that the majority of ratepayers will provide their information because they want to ensure they are paying the right tax based on accurate property valuations. The compliance framework will focus on making it easy to comply, and supporting those who may find it hard. The government wants to create a system of compliance that is light-touch, simple for individuals and businesses, and avoids creating unnecessary bureaucracy. We expect that a system like this will be better for customers, will achieve higher levels of compliance and, as a result, lead to more accurate rating lists.

2.4 To tackle non-compliance, the government will introduce a fair and proportionate compliance regime to ensure that ratepayers who do meet their obligations are not unfairly disadvantaged. The proposals aim to provide scope for lenience where appropriate, while offering a genuine deterrent to those who deliberately and repeatedly do not provide the information required of them. But the government considers issuance of penalties to be a last resort; to be used only where necessary and where other measures such as reminders are ineffective. The principal objective of this compliance activity will be to ensure that the information needed for frequent and fair revaluations is provided at the right time – not to raise revenue through issuance of penalties.

2.5 Across the tax system, the government seeks to focus on supporting customers to comply and taking proportionate action to tackle non-compliance which, in turn, bolsters public trust in the tax system. By bringing the business rates valuation procedure in line with other taxes through the introduction of an element of ratepayer self-declaration, the government wants to achieve similarly strong results. Sometimes sanctions will be necessary, but the government’s objective will be to ensure, as much as possible, a proportionate compliance regime without the need for sanctions.

2.6 The government recognises that this framework will place obligations on some people to self-declare in relation to a tax they do not pay, because of reliefs. It is therefore vital that all those captured by the duty become aware of their responsibilities and that it is easy for them to comply. We propose to make that a straightforward process through our plan for an effective compliance system. This chapter sets out that vision and invites views from the public.

The online service

2.7 As set out at 1.16, there will be a single online destination for ratepayers or their agents to access to comply with the new obligations. The government will ensure that the online service makes compliance as straightforward as possible for all ratepayers. It will be a recognisable Gov.uk digital service akin to other tax services. We anticipate that it will be well signposted by local billing authorities as well as other government sites used by businesses.

2.8 All ratepayers (including those occupiers of multiple properties) will be able to sign up to the online service in respect of their properties. The process of signing up will enable ratepayers to confirm the properties for which they are responsible for business rates purposes, as well as to review and (if necessary) edit the factual property and valuation information held by the VOA relating to their properties. Ratepayers will also be reminded at the point of signing up of their obligations under the duty, any relevant dates and consequences for non-compliance, as well as links to helpful guidance and examples. The online service will partially replicate the system the VOA use for collecting information (called “Forms of Return”) as well as providing a route for ratepayers to provide other information required under the duty, such as information about changes to a property. Where possible, over the longer term, the government will also seek to minimize instances where ratepayers may be asked to provide the same or similar information to government more than once.

2.9 Once signed up, ratepayers will simply need to log back into the online service to update their information and then also complete their annual confirmation – which for most ratepayers most years, where there have been no notifiable changes, should only take a few minutes.

2.10 We recognise that for some ratepayers the requirement to provide regular information to the VOA will be new, particularly for ratepayers who may pay no business rates as a result of relief. However, for the business rates system as a whole, comprehensive provision of information will better ensure confidence that ratepayers are paying the right amount of tax, reducing the need for backdated changes to bills. The information provided by ratepayers will also support more accurate valuations for both their own properties and similar properties around them. In addition to making the online system easy to use, the VOA will conduct a wide-ranging and ongoing communications campaign to ensure ratepayers are aware of the need to sign up to the service and provide the right information.

2.11 The government will not formally activate the duty until we are satisfied that ratepayers can reasonably and efficiently comply with it through engagement with the VOA online service. It is, however, envisaged that the duty will take effect during the 2023 list.

Deadlines for return of information

2.12 Where an obligation has been triggered (for example where there has been a change to the property) then ratepayers will be required to log in to the online service to provide their information in a 30 calendar day window. The online service will guide registered users through simple steps to understand how they are engaged by the duty, and guidance and resources will be provided to support ratepayers to understand what information is relevant and needs to be provided.

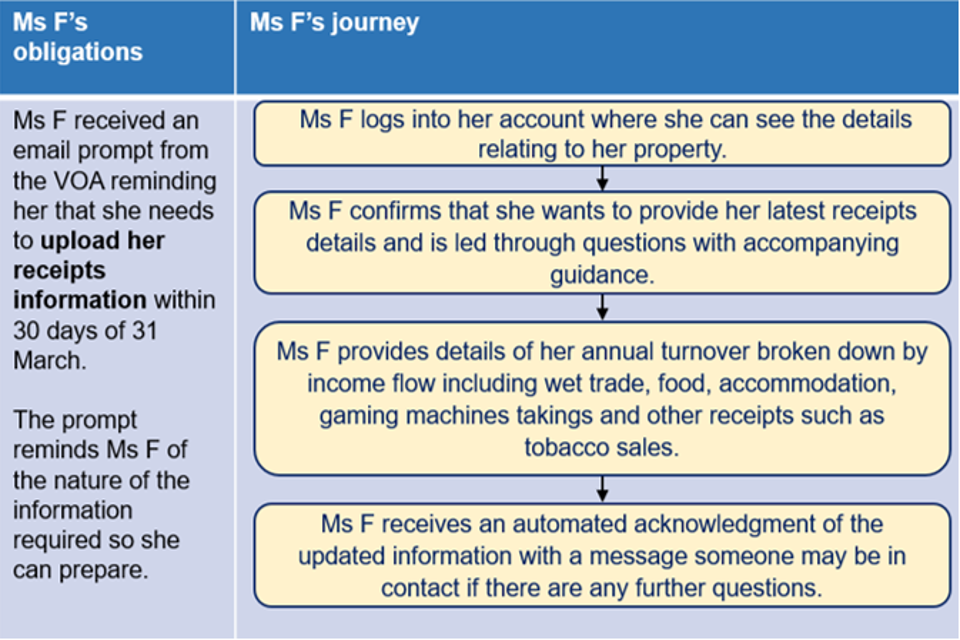

2.13 We envisage that where the VOA knows of an upcoming notifiable event, such as a rent review, then they will send prompts to ratepayers registered on the online service to remind them of the information they need to provide and notification timeframes.

2.14 For rental information, the requirement to provide information will be triggered when a formal agreement (or amended agreement) becomes legally binding. In the case of an informal agreement, it will be the date the rent (or any subsequent amended rent) is payable. Examples include:

- signing a new lease

- signing a formal tenancy agreement, including sub-lets

- if an informal tenancy agreement, including sub-lets, the date rent is first paid

- if details of the informal tenancy are changed with the signing of a formal agreement, this will again trigger the duty

- signing a rent review memorandum

- signing a lease renewal agreement

- where there has been a change in rent, e.g. as a result of Company Voluntary Arrangement (CVA)

- where there has been a change or addition to a tenancy agreement, e.g. side agreement, change of terms

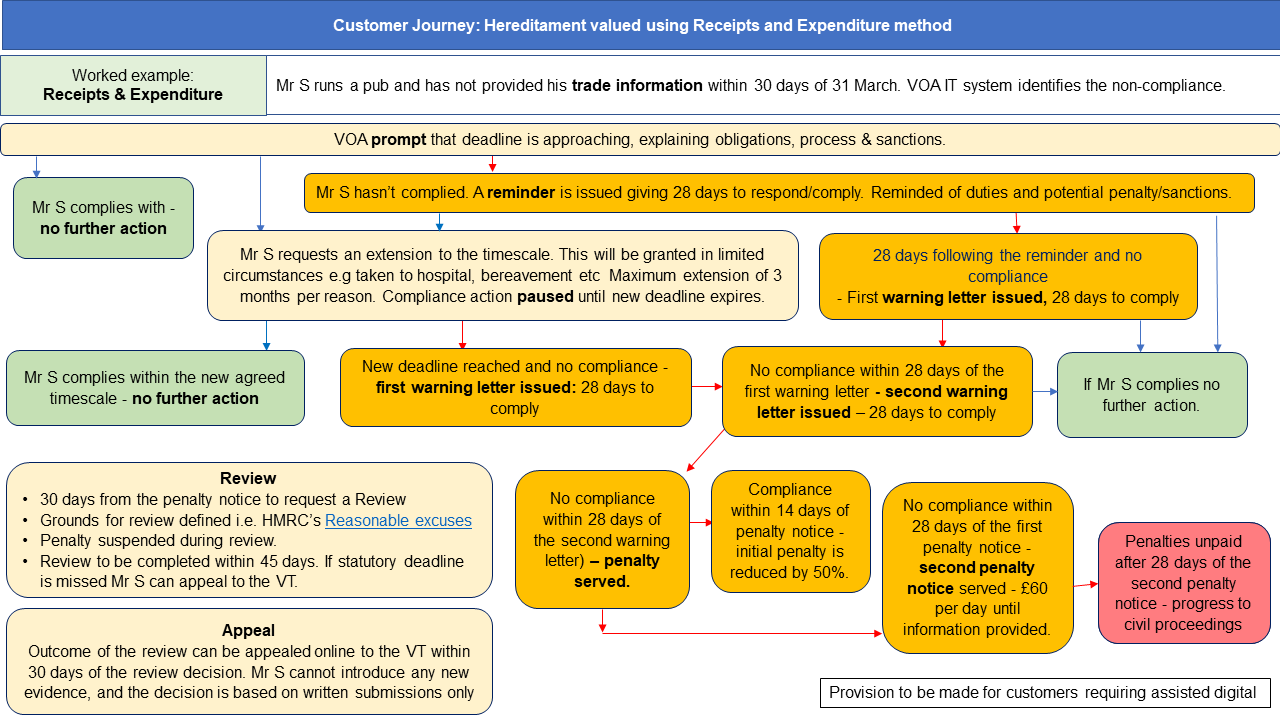

2.15 For receipts information (for ratepayers for properties which are normally valued directly or indirectly having regard to turnover), information should reflect their business’ annual accounting period (financial year) and be supplied within 30 calendar days of 31 March.

2.16 For changes to occupation or property characteristics, the requirement to provide information will be triggered by events such as:

- new occupation or the ending of an occupation

- property is extended, or other physical alterations are completed.

- when there has been a change in use of the property.

2.17 For the annual confirmation, ratepayers will need to confirm within 30 calendar days of 31 March each year that they have met their obligations under the duty during the previous year and that the details held by the VOA remain accurate and up to date. Where there have been no changes, this will simply require ratepayers to check the information and tick boxes.

2.18 Where Forms of Return for costs information are used, the current 56-day deadline for responding will be reduced to 30 calendar days to align with the other information requirements.

Sanctions

2.19 Once the government is satisfied that ratepayers can reasonably and efficiently provide their information through the online service, we will introduce a sanctions regime to support ratepayers to do so. This is not expected to be introduced before 2026. The new framework will give ample opportunity for ratepayers to meet their obligations and will include leniency for genuine errors. But for those who do not provide their information in a timely or accurate way, the VOA will consider applying penalties, and placing restrictions on those ratepayers being able to challenge their rateable value and access additional information about how their rateable value was calculated (see chapter 3).

Penalties

2.20 Ratepayers may be liable for a penalty for each instance where they fail to notify the VOA of relevant information. The penalty level, and the number of penalties, will be dependent on the type of information that is not provided, such as valuation information or property information. Valuation information will generally impact a wider pool of ratepayers, not only the ratepayer providing it, as it is likely to inform a valuation scheme. Property information is specific to the individual ratepayer.

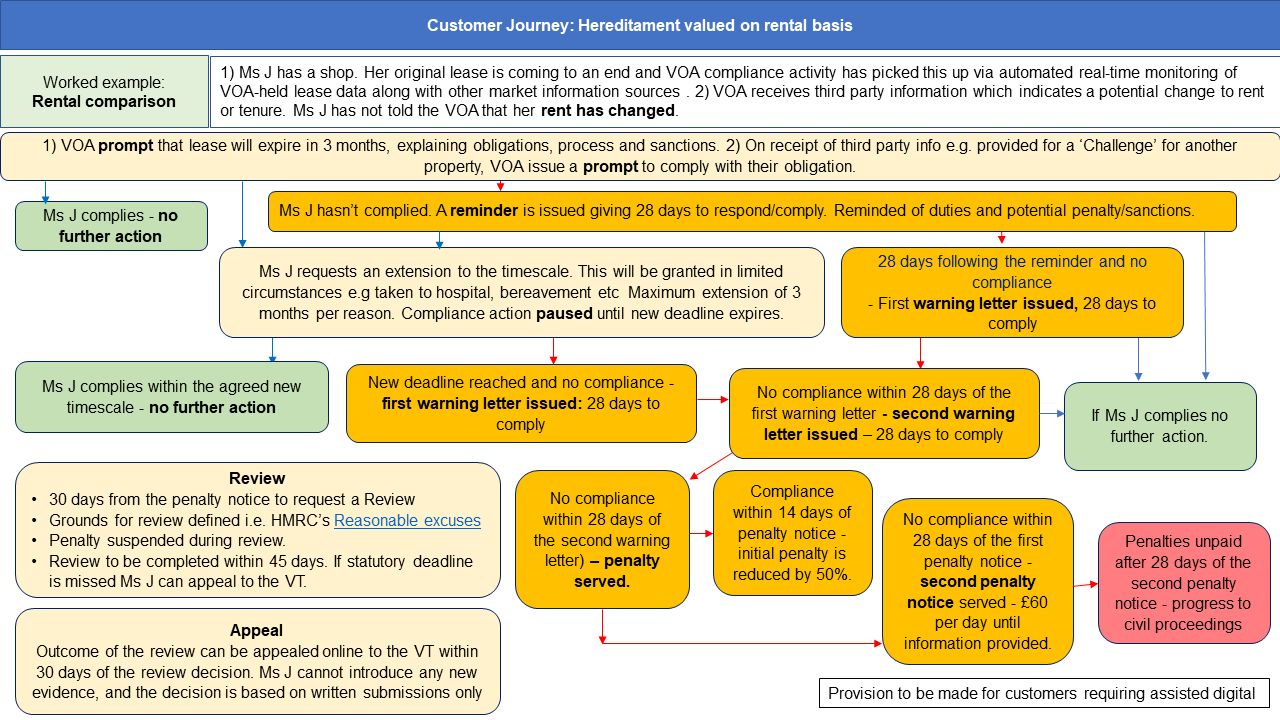

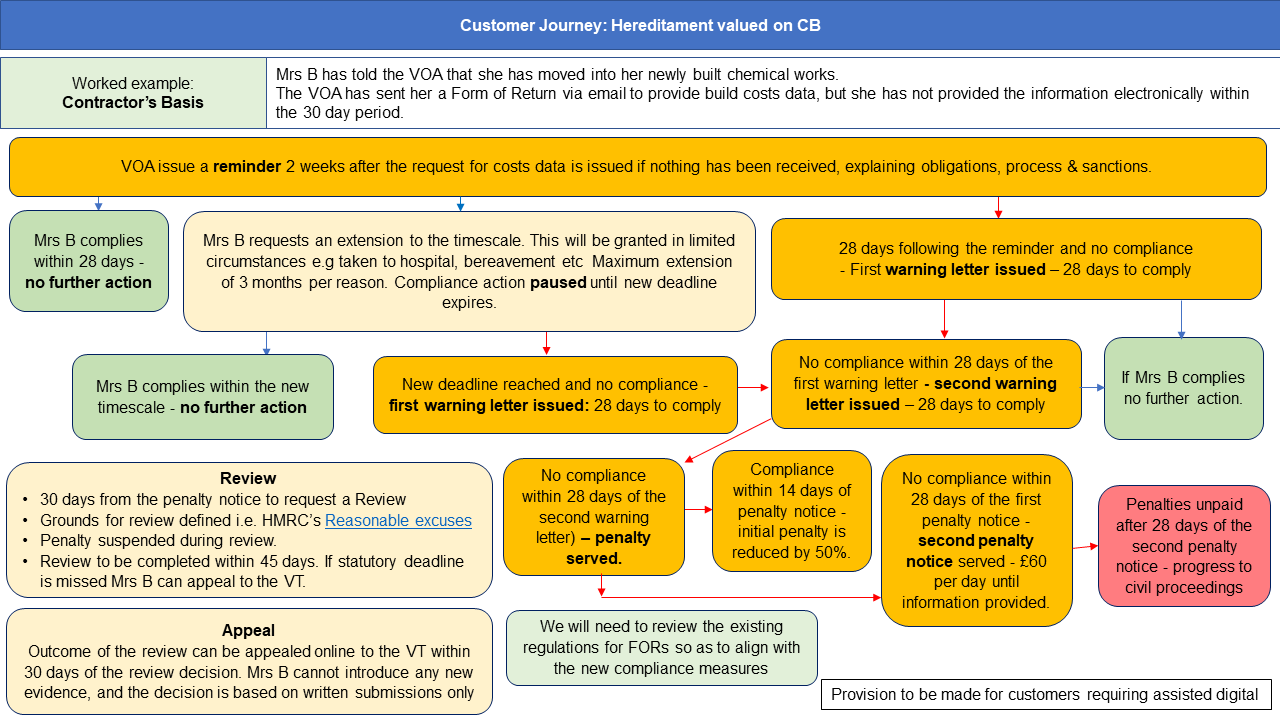

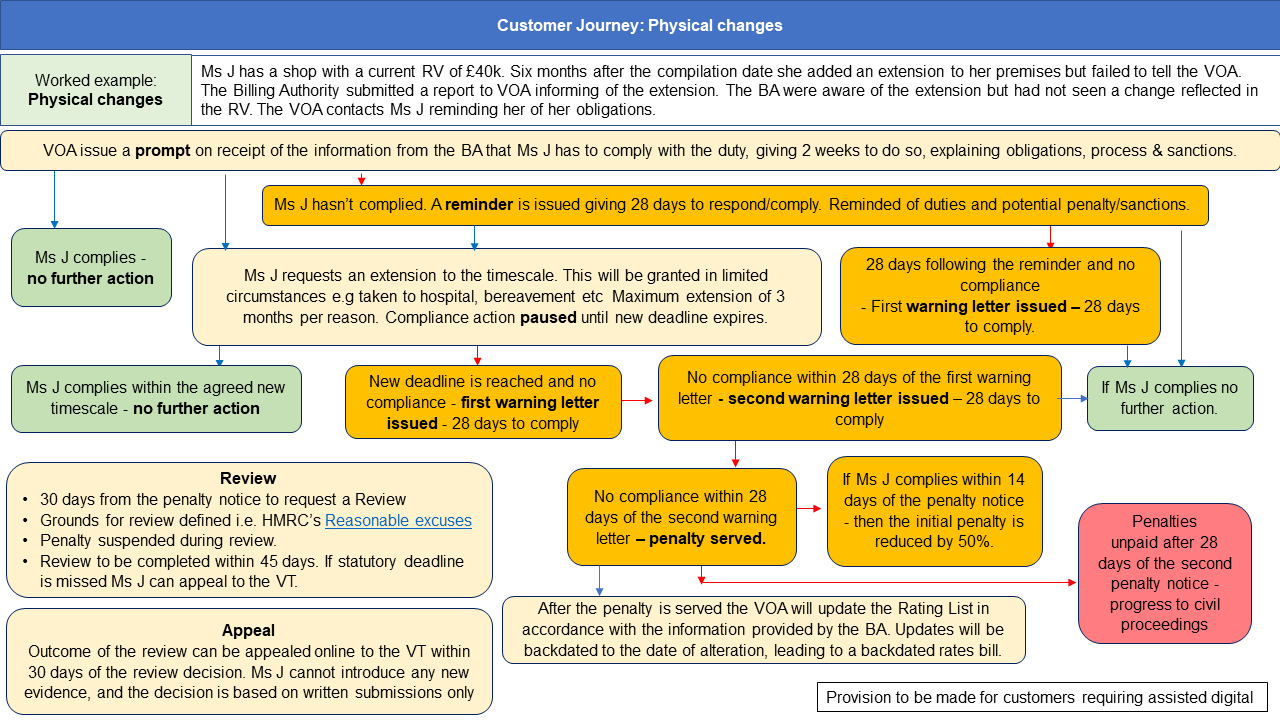

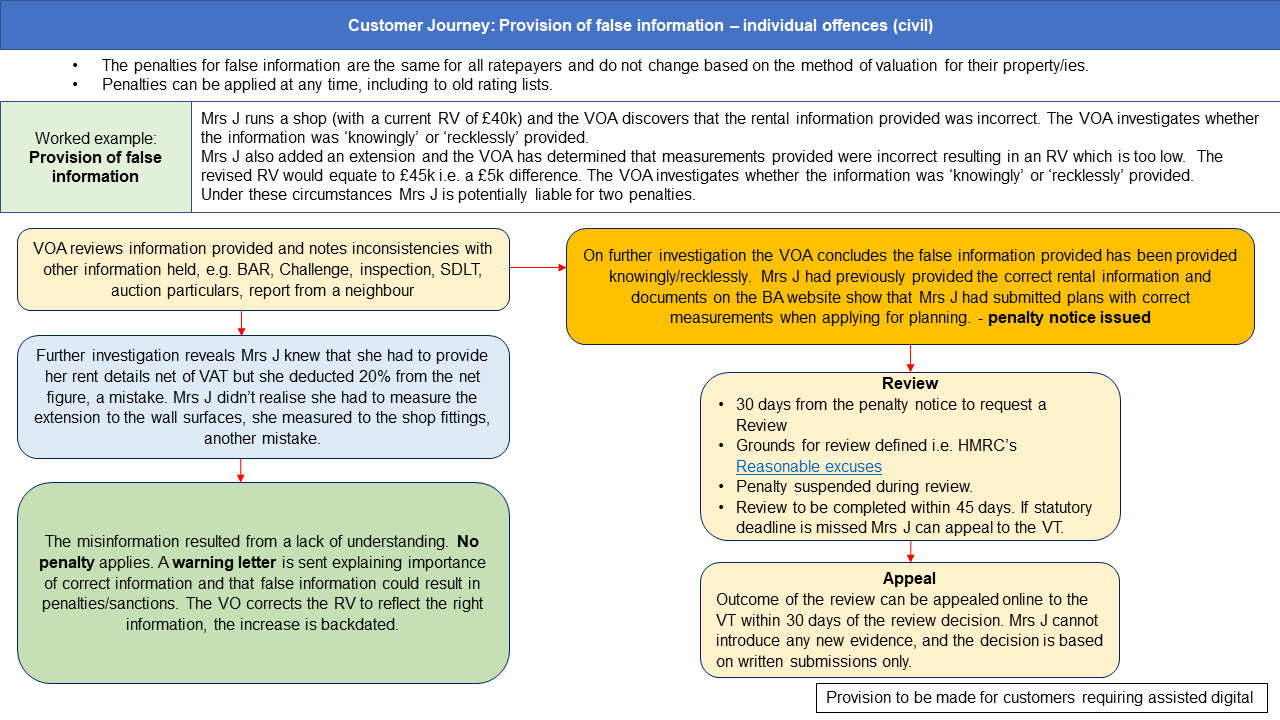

2.21 After the initial 30 calendar days from the notifiable event, if there is no evidence of compliance then the VOA will issue a electronic reminder letter to the ratepayer telling them they need to provide the required information within 28 calendar days and warning that failing to do somay result in a penalty. If the required information is still not provided after a further 28 calendar days after the electronic reminder letter, an electronic warning letter will be issued telling them they need to comply within another 28 calendar days and that continued non-compliance may result in a penalty. If the duty continues not to be complied with for 28 calendar days another electronic warning letter will be issued, this time also in hard copy, again telling them they need to comply within another 28 calendar days and that continued non-compliance may result in a penalty. If there is still no compliance at the end of that 28 calendar day window, a penalty notice will be issued.

2.22 However, if the ratepayer provides the required information within 14 calendar days of the penalty notice being issued, the value of the penalty will be halved.

2.23 Where the penalty notice relates to non-compliance for valuation information (for example provision of updated rental information or submission of annual receipts information) and there is no compliance after 28 calendar days of the first penalty notice, we envisage that a second penalty notice will be served. This approach broadly aligns with penalty regimes across other taxes. Further illustrations of this can be found in the customer journey illustrations below.

2.24 The government does not envisage applying penalties in instances where a ratepayer fails to comply with their annual confirmation obligation. Instead however, failure to comply would give rise to further VOA compliance activity and, where applicable, would give rise to subsequent penalties under the other obligations. This will better ensure penalties discern between mistakes and repeated non-compliance.

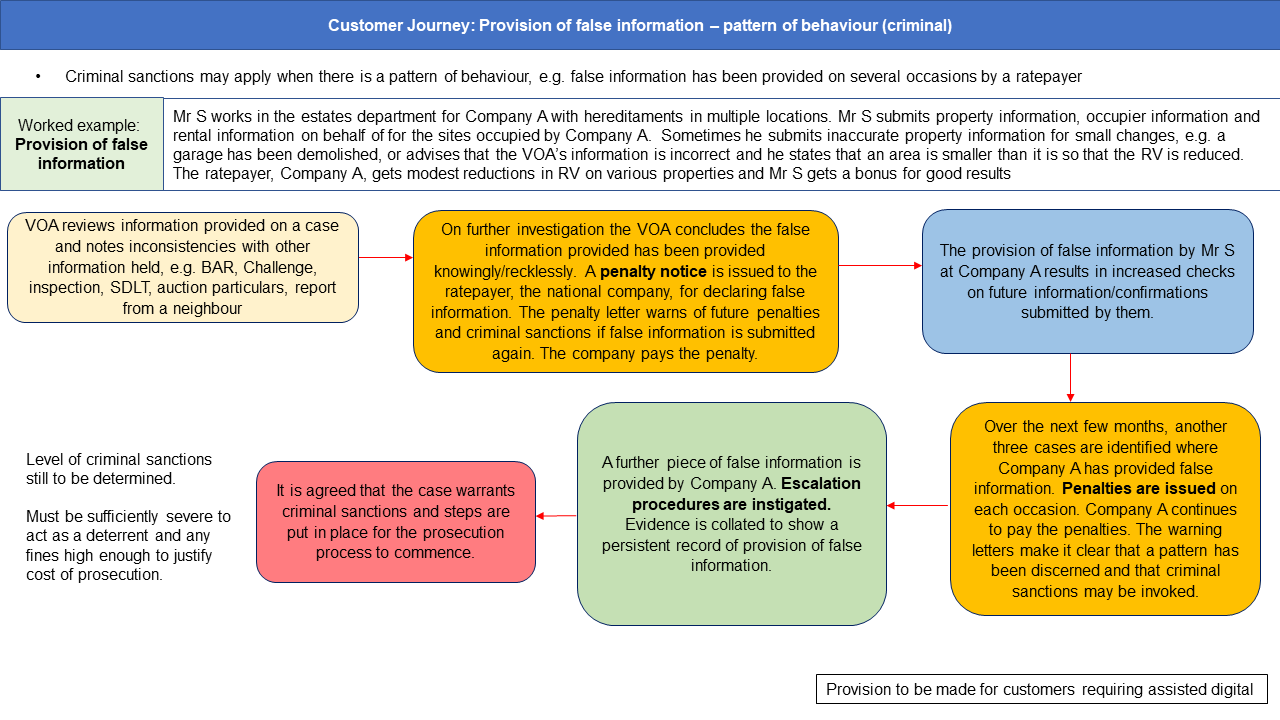

2.25 The VOA will be able to apply penalties for failure to notify at any time after the non-compliance is identified, including failure to comply during a previous list. Where a penalty is based on current rateable value, the rateable value used will be fixed as at the date of the penalty notice and be unaffected by any subsequent backdated change.

2.26 There will also be penalties for knowingly or recklessly providing information that is false and, if relied upon, may lead to an inaccuracy in a list. Where the VOA finds it has been provided with false information there will be a fixed penalty per piece of information found to be false (with no reduction if this is paid quickly) and an additional penalty based on any rateable value difference arising from the false information. Illustrations can be found below.

2.27 The VOA will maintain records and build a picture of customers’ individual compliance, to allow it to distinguish between one-off failures to comply and repeated and deliberate non-compliance with any (and each) of the requirements. This will inform a proportionate approach to compliance activity and ensure resources are targeted effectively.

Penalties – tariffs

2.28 The business rates system already includes penalties, for example, in relation to non-return of rental information requested by the VOA. Existing penalty provisions will be retained and updated to bring them in line with the penalties for the new duty. The tables below set out the proposed penalty levels. These penalty levels are proportionate to similar penalties elsewhere in the tax system, for example, some HMRC penalties are based on a percentage of the potential for lost revenue and range from 0 – 100% depending on the type of behaviour displayed by the taxpayer. The structure reflects that larger penalties will be needed in situations where non-compliance leads to a significant under-assessment of rateable value (and therefore tax).

Table 1: Failure to provide information

| Rateable value | Up to £15k | £15,001-£51,000 | Over £51k |

|---|---|---|---|

| Rental, Receipts and cost information | |||

| First penalty - fixed penalty which may vary according to rateable value | Fixed penalty of £300 | Fixed penalty of £600 | Fixed penalty of £900 |

| Second penalty for continuing non-compliance - £60 per day until compliance | £60 per day until compliance | £60 per day until compliance | £60 per day until compliance |

| Property, occupier information | |||

| Penalty - 2% of rateable value change but not less than £300 | Variable (£300 minimum) | Variable (£300 minimum) | Variable (£300 minimum) |

Table 2: Provision of false information

| Rateable value | Up to £15k | £15,001- £51,000 | Over £51k |

|---|---|---|---|

| Fixed penalty | £500 | £500 | £500 |

| 3% of RV difference arising from the false information | Variable | Variable | Variable |

Penalties - Extensions, reviews, appeals and remittances

2.29 We will build flexibility into this system to allow the VOA to operate these sanctions fairly and with due regard to individual circumstance.

2.30 Ratepayers will be able to request to extend the timescales if they need more time to meet their obligations. Extensions will be available in limited circumstances where there is a compelling reason such as a medical emergency or bereavement and will be subject to a maximum of 3 months extension. The VOA will provide further guidance to explain when this option is available but will look to draw on existing HMRC practice as appropriate.

2.31 Ratepayers will have the opportunity to request a review of penalty decisions before moving to the appeal stage. They can ask for a review based on a set of mitigating criteria (based on HMRC’s approach to Reasonable Excuse) within 30 calendar days of the issuing of a penalty notice. Penalties will be suspended during a review, which must be completed within 45 calendar days, or the ratepayer will be able to appeal to the Valuation Tribunal England (VTE).

2.32 To begin the review, the ratepayer will complete a simple online form, similar to appealing a parking ticket. The review itself will be conducted by an independent VOA caseworker, and an appeal may be lodged with the VTE within 30 calendar days of the decision. The VTE will be able to order the VOA to remit, in part or in full, the penalty in question.

2.33 The VOA will have discretion to remit in full any penalty imposed for failure to comply or provision of false information, whether or not an appeal has been lodged or a tribunal judgement made.

2.34 The VOA will ensure that a user-friendly penalty payment system is available for ratepayers to use.

Access to challenge

2.35 In addition to the penalties set out, ratepayers will only be able to access Challenge (the system for challenging a rateable value) if they are up to date with their obligations under the duty (including annual confirmation). This is consistent with existing requirements on ratepayers to have completed a Check of the factual data about their property before they can proceed to make a Challenge against the valuation.

Access to transparency

2.36 Ratepayers will also have to be compliant with the duty to access information about how their rateable value was calculated under the new service providing greater valuation transparency (see chapter 3).

Consultation questions – Chapter 2

Q5. Does the proposed framework strike the right balance between a system of proportionate and flexible sanctions, and one which helps ratepayers to meet their obligations?

Q6. What would you wish to see in an online service to best help ratepayers meet their obligations?

Q7. Under what circumstances would 30 days not be enough time for ratepayers to meet their obligations?

Q8. What processes might ratepayers have to put in place to meet their obligations and what costs might this bring?

Q9. Do you have any suggestions for how this compliance framework could be improved? If so, please provide evidence or scenarios.

Chapter 3: Appeals reform and transparency

Introduction

3.1 Reforming the appeals system is an important part of achieving a sustainable cycle of 3-yearly revaluations. To manage the flow of appeals and enable the VOA to approach the clearance of challenges in a more structured way the business rates review announced:

- Clarification that factors arising from legislation, licencing changes or guidance are not in scope for material change of circumstances (MCC) claims.

- The removal of the Check stage from the Check, Challenge, Appeal (CCA) process from the 2026 rating lists and introducing 3-month window for Challenges on the 2026 rating lists.

3.2 In response to an important ratepayer request, the review also concluded with the announcement that the government would implement a staged process to increase transparency about how valuations are reached.

Material Changes of Circumstances (MCC)

3.3 A system of regular 3-yearly revaluations will ensure that rateable values are more up to date and reflect changes in the economy and the property market. It is at these general revaluations that rateable values, and therefore rates bills, are updated to reflect changes in economic factors, market conditions or changes in the general level of rents. Between revaluations the determination of rateable values can only be changed to reflect “material changes of circumstances” including, for example, physical changes to the property or the locality. However, the scope of material change of circumstances should not be so wide as to capture changes in economic factors, market conditions or changes in the general level of rents as that would be akin to real-time revaluations, impracticable and undermine the role of the revaluation. Changes in such matters should not result in a change of rateable value between revaluation.

3.4 Earlier this year the government introduced legislation to ensure that the impact on rental values of COVID-19 or interventions in response to the coronavirus pandemic should not result in changes to rateable values outside of a revaluation[footnote 1]. That legislation will ensure that the proper divide between revaluation and material changes of circumstances is maintained in respect of coronavirus.

3.5 Inevitably, there are and will be other events which occur between revaluations which by their nature concern the economic or market conditions or the general level of rents rather than, for example, property specific effects such as changes to the physical state of the property (such as internal demolitions) or the locality (such as roadworks).

3.6 The government set out its view in the summer consultation that the use of the MCC provision had, in practice, extended beyond its original intention, and that reform was needed to ensure that the provision remains fit for purpose for all ratepayers.

3.7 Whilst steps have been taken to address this in respect of coronavirus, further reform is needed to make sure the law is clearly and fairly calibrated, and that ratepayers, local government and the VOA can understand what should be reflected at revaluations and what should be reflected as material changes of circumstances.

3.8 Therefore, the government announced in the business rates review that it will clarify that certain other changes between revaluations in the nature of changes in economic or market conditions or the general level of rents are not an MCC. As set out in the Final Report, the government will legislate to clarify that factors arising from legislation, changes in licencing regimes, or guidance concerning how a property should be used, are not in scope for MCC claims.

3.9 Applying legal boundaries to the scope of MCCs is not about limiting access to appeals or ensuring that rateable values never change to reflect these events. Rather it is about ensuring these matters are reflected at revaluations: thereby restoring the scope of the provision to its originally intended extent, future-proofing the system against another Covid-type event, and making the provision clear and unambiguous. To do this we will clarify the statutory assumptions which underpin valuations in order to bring clarity and certainty as to whether or not a change is an MCC.

Matters which should not constitute an MCC

3.10 The government wishes to make sure that rateable values are based on the legislative landscape at the preceding AVD, by clarifying that changes to legislation do not constitute MCCs. To ensure the coherence and simplicity of the system, all legislation will be covered including changes to private or hybrid legislation and by-laws.

3.11 The government also wants to make sure that changes in licensing regimes should not give rise to an MCC. Licensing regimes are run by public bodies with powers under legislation to administer licenses and create, apply and enforce rules to govern the operation of certain industries and sectors. The government considers that, like legislation, licensing regimes in effect set the economic context for the occupation and use of particular properties. Therefore, changes to these regimes should not give rise to an MCC but rather should be considered at revaluations.

3.12 We also consider that advice or guidance issued by a public authority concerning how a property should be used is of a nature which means it should not give rise to an MCC. Advice or guidance from a public authority which concerns the enjoyment of a property is generally less common than legislation or licensing regimes which have the same effect. But the means by which public bodies implement their responsibilities is sometimes through advice or guidance and, like legislation or licensing regimes, sets the economic context for the use of the property. This will ensure that, for example, changes in health and safety guidance issued by HSE does not give rise to an MCC.

3.13 The government recognises that there are circumstances in which regulatory changes may have secondary consequences and that recourse to appeal should be available for these cases in respect of those physical changes. Ratepayers will still be able to make an MCC Challenge on the basis of the following matters even where they have been caused by a change in legislation, licensing or guidance:

- a physical change to the property

- a physical change in the locality

- the property joining or leaving the categories ‘domestic’ or ‘exempt’

- the property forming or no longer being a “hereditament” (the term used to describe a unit of property for business rates).

3.14 The VOA will still assess the rateable value on the basis of the landscape of legislation, licensing and advice/guidance that existed at the AVD, but changes in the matters set out above (even if caused by a regulatory or licence change since the AVD) will remain eligible grounds for an MCC. For example, a road closure indirectly caused by a by-law may still be in effect an MCC but the legislative instrument itself would be out of scope.

3.15 This approach will bring the MCC provision back in line with the original intention of the parent legislation and ensure that it can be sustainably applied to all eventualities according to a coherent, predictable set of rules.

3.16 We expect these changes to take effect for the start of the 2023 lists.

Improvements to CCA

3.17 In line with the Final Report of the Review, we will also proceed with streamlining the appeals process through the removal of the check stage of the CCA process and the introduction of a 3-month window for submitting Challenges. Both will apply from the 2026 rating list.

3.18 Currently ratepayers have to complete a check before making a challenge. Checks enable ratepayers either to confirm their property details are correct or to notify the VOA of changes. The requirement to update property information under the new duty will ensure that property details held by the VOA are correct and agreed before proceeding to challenge. Therefore, the new duty will make check essentially redundant. Fulfilment of the duty including annual confirmation will be a condition of access to challenge, in the same way that completing the check stage under the current system is also a condition of making a challenge.

3.19 The reformed system of 3-yearly revaluations will require changes to how and when challenges are processed, to ensure that they are dealt with in a timely fashion relative to the beginning and end of lists. We intend to reduce the window for making compiled list challenges to 3 months from the beginning of lists. This will ensure quicker overall resolution and greater certainty for local authorities. The change will also enable the VOA to process challenges more efficiently and informed by greater contextual knowledge, which will improve the speed and quality of service provided.

3.20 Ratepayers will be able to access their rateable values from the publication of draft lists several months prior to the beginning of new lists, leaving ample time for the evaluation of the VOA’s reasoning and preparation of a challenge if needed. The government intends that the introduction of greater transparency measures should enable ratepayers to make swifter, more informed judgments about their rateable value, and we will explore making this available at the draft list stage.

3.21 As envisaged in the summer consultation, an overall statutory deadline for all compiled list challenges will apply at the end of the list, in place of the current statutory time limit of 18 months – although a majority of Challenges are expected to be cleared well in advance of this deadline.

3.22 The final report of the government’s review of business rates set out the expected timescales for implementing these measures. Check will be removed from the outset of the 2026 lists. In order to enable the removal of check, the duty to notify provision will be phased in and subject to a soft launch and considerable user testing during the 2023 list. The challenge window will be reduced to 3 months from the start of the 2026 list.

Transparency

3.23 The government will also implement a 2-phase process to provide ratepayers with greater transparency on their valuations. This will meet an important stakeholder ask, support ratepayers to understand how their valuation has been calculated and make more informed decisions about when to submit an appeal.

3.24 In Phase 1, expected to be implemented for the the 2023 lists, ratepayers will be able to access improved guidance covering rating principles and class-specific valuation approach.

3.25 In Phase 2, expected to be implemented for the 2026 lists, ratepayers will be able to access fuller analysis of rental evidence used to set an RV for a specific property, an explanation of how the evidence has been used to arrive at the RV and further guidance. The evidence, which might include tenure periods, lease terms, and analysed price per m2, will be accessible to ratepayers who are up to date with their obligations under the duty on request via the online service. Ratepayers will be able to submit this request separately from and prior to the Challenge process.

3.26 Ahead of launching the second phase of the transparency process, the VOA will provide ratepayers with further information and guidance about the types of information that will be accessible and how this will be made straightforward for customers.

Consultation questions – Chapter 3

Q10. Do you consider that the proposed reform to the rules on MCCs will ensure that changes in economic factors, market conditions or changes in the general level of rents are reflected at revaluations? If not why not?

Q11. What are your views on the proposed improvements to the CCA system. How else could we improve CCA in a system under which ratepayers are now providing information under the new duties?

Q12. Are there particular considerations that the respondents consider the government should have particular regard to when moving forward with phase 2 of transparency?

Chapter 4: Improvement relief

Introduction

4.1 The government has announced a new relief to support investment in property improvements. This will enable businesses to adapt to meet rising demand, make improvements to their premises, and enhance productivity as employees return to the workplace.

4.2 The measure will be introduced in 2023, and will be reviewed in 2028. This section of the consultation sets out our proposals for how the improvement relief will work, including scope and eligibility considerations.

Conditions for improvement relief eligibility

4.3 To receive the improvement relief, ratepayers will need to demonstrate that their property meets 2 conditions:

- the VOA must be satisfied that the improvements meet the definition of qualifying works - the ‘qualifying works’ condition, and

- the relevant local billing authority must be satisfied that in the period since the qualifying works commenced the property has remained occupied and that the ratepayer has not changed – the ‘occupation’ condition.

4.4 Once the VOA is satisfied that the qualifying works condition has been met then it will issue a certificate of the increase in rateable value which is attributable to any works falling within the meaning of qualifying works. The billing authority will then apply the relief using the certificate but only if the occupation condition has been met.

The qualifying works condition

4.5 Ratepayers should have clarity about the types of activity which would make them eligible for the new relief. The parameters for meeting the qualifying works condition reflects the government’s objective of supporting businesses to make practical improvements to their properties to support their business and growth. Qualifying works must result in a positive change in the rateable value to be eligible for relief. Any improvements which result in no overall change in rateable value or a reduction due to simultaneous value-supressing activity, such as demolition works, will not be eligible for the relief. Therefore, in order to fall within the meaning of qualifying works, the improvements will need to produce:

- an increase to the size of a building or the internal useable space within a hereditament,

- other improvements or upgrades to the property’s physical state which might include addition of heating, air conditioning, or raised flooring, or

- addition of other rateable plant and machinery

4.6 Examples of the type of works which may meet the definition of qualifying works are (assuming all remain in a rating list and under the same occupation):

- A business adds insulation or new lining to a previously uninsulated old industrial property resulting in an increase in value of the property.

- A business makes a physical extension to their property, like an extension to the rear.

- A shop removes a structural wall within its front part. This could increase the rateable value as the areas previously behind the wall are now able to be used for retail purposes rather than storage.

- A business adds a structural mezzanine retail area at their retail warehouse.

4.7 A change of use alone (for example changing a shop to a bar) would not constitute qualifying works, although any of the above works associated with that change of use might still be eligible. The addition of land to an existing property, the construction of a new hereditament outside the existing property and repair works are also not eligible for relief. However, a new build on part of an existing property, like a new building on a large factory site, would be treated as an extension or improvement to that site, and hence be eligible for relief. Should a ratepayer undertake a scheme of works which results in the division of a property into multiple different rating assessments, then this may still qualify provided the other tests are met. For example, if the occupier of an industrial unit undertakes some qualifying works and also divides part of their property for use by a different tenant then the works may still qualify but only on the part they continue to occupy.

4.8 The object of the relief is to help occupiers making improvements in support of their existing business premises and is not intended to subsidise general commercial property development such as new construction or refurbishment. Given that such major works generally result in the property leaving the rating list, for ease and clarity the government will provide that the meaning of qualifying works will exclude works where the property was not entered in a rating list during all or part of the period of the works.

4.9 Examples of the types of works which may not meet the definition of qualifying works are:

- Construction of a new building resulting in a new rating assessment.

- A redevelopment scheme which takes a property out of the rating list, but after substantial redevelopment the property is brought back into rating.

- Replacing an old technology such as Asbestos lining with a different type of modern insultation with no resulting change in rateable value.

4.10 These determinations will be made by the VOA which, once it is satisfied the eligibility conditions have been met, will issue a certificate of the change in rateable value which is attributable to any works falling within the meaning of qualifying works.

The occupation condition

4.11 The government wishes to target the relief to support ratepayers investing in their own active businesses and ensure we do not divert support to property developers, landlords improving their asset or businesses which have merely inherited improvements from previous occupiers. To meet this objective, we will ask billing authorities to apply a further condition before awarding relief – the occupation condition. In order to meet the occupation condition billing authorities will have to be satisfied that in the period since the qualifying works commenced the property has remained occupied and that the ratepayer has not changed.

4.12 The occupation condition will ensure as much as possible that we maximise the impact of that support, that the relief is not in effect inherited by new ratepayers with no connection to the works and that support does not flow to landlords or developers making improvements to their asset. In the case that landlords make improvements to their asset, the occupier of the property will be eligible for the improvement relief, given that the occupier is likely to face higher overall rental/commercial costs due to the improvements. Billing authorities will need to be satisfied that the occupation condition is met before awarding relief.

Certification

4.13 Once the conditions are met, the billing authority will need to calculate the relief based on a certificate issued by the VOA. This will certify the change in the overall rateable value of the property which is attributable to any qualifying works. So, for example, where a shop removes a structural wall to increase the most valuable retail space then the certificate will reflect the net increase in rateable value resulting from the additional retail space. The government considers that such a process can be effective without significant changes to VOA or billing authority operating practices, and that certification is the best way to ensure that the evidential link between rateable values and the application of the relief is maintained.

4.14 To ensure that link is sustained in line with the VOA’s responsibility for list accuracy, we will design the certification to be flexible and amendable. The certificate will have daily effect for the year of its life, and the VOA will be able to revisit it should any part of the property affected by the qualifying works change during the year. The VOA will be able to withdraw or amend a certificate at its discretion, for example to reflect changes in facts or errors relating to the certified qualifying works. Any subsequent changes on a property which the VOA concludes are not a variation of the original qualifying works but a new set of qualifying works could result in a new certificate being issued for a year. Separate qualifying works on the same property in the same year may result in separate certification.

4.15 Ratepayers will continue to be able to challenge list alterations made by valuation officers, through the existing appeals process, to reflect qualifying and other works.

4.16 We envisage that certificates will be issued by the VOA proactively when a ratepayer fulfils their obligation to notify changes and will be sent to the billing authority and copied to the ratepayer.

Calculation of chargeable amount

4.17 We recognise that such a relief must be carefully designed to ensure it complements other reliefs. The government does not wish any ratepayer who has undertaken qualifying works to see an increase in their bill for 12 months as a result. For that reason, it is necessary to ensure that any interactions with other reliefs do not serve to penalise the ratepayer who has undertaken qualifying works. We are therefore proposing a new methodology for billing authorities to calculate bills: for the duration of the certificate, the chargeable amount for properties which meet the conditions will be calculated as if the rateable value in the list for the day was the rateable value shown in the list less the value of the certificate. This is a more nuanced approach than simply asking billing authorities to reduce the chargeable amount, will be simpler for billing authorities and will ensure that ratepayers can have confidence that undertaking a scheme of qualifying works will not result in their effective rateable value increasing as a result of those works.

Consultation questions – Chapter 4

Q13. Will the proposed rules for the improvement relief ensure the relief flows to occupiers who are investing in their business?

Q14. Do you consider that the 2 conditions will give effect to the stated policy intent? Do you have any concerns regarding the practical application of the conditions as set out?

Q15. Do you agree that the proposed method of reaching the chargeable amount will achieve the objective of preventing ratepayers who have undertaken qualifying works from seeing an increase in their bill for 12 months as a result of the qualifying works?

Chapter 5: Green measures

Introduction

5.1 This chapter concerns a number of measures the government is taking through the business rates system to support the use of green technology and decarbonise buildings. The technologies within scope of these measures are tangible, rateable parts of buildings with the potential to support decarbonisation.

Renewable plant and machinery exemption

5.2 The business rates review announced that eligible plant and machinery used in onsite renewable energy generation and electricity storage, such as rooftop solar panels, wind turbines, and battery storage, plus electricity storage from any source where it is being used for electric vehicle charging points (EVCPs) will be exempt from business rates from April 2023 until 2035. These exemptions will bring the treatment of onsite renewable energy generation and storage in line with that used to export energy to the grid and provide support for storage plant and machinery used to fuel electric vehicles.

5.3 This measure responds to the feedback of stakeholders, many of whom expressed an interest in exemptions or relief for new and existing green technologies such as solar panels to support businesses’ sustainability goals.

5.4 While some stakeholders expressed an interest in other green technologies, such as heat pumps or EVCPs, the business rates system does not act as a barrier to adoption in these cases. For instance, the plant and machinery for EVCPs is not rateable, so there is no difference in rateable value for a parking space with an EVCP and one without. There is also currently no difference in market values between buildings that are heated conventionally and those that are heated via renewable fuels or technologies, therefore replacing a gas boiler with a heat pump or other form of low carbon heating should not lead to an increase in rates bills.

5.5 The object of the exemption will be to bring onsite generation and electricity storage from renewables (plus electricity storage used for EVCP) into line with renewables being used to export electricity to the grid (where an exemption already applies). Accordingly, the exemption will apply to items which would otherwise fall to be rateable under class 1 of the “Plant and Machinery regulations”[footnote 2] – items used in connection with the generation of power from renewables. For the avoidance of doubt, items which are either very large or in the nature of a building or structure may still be rateable under class 4 of the Plant and Machinery regulations but for renewables we expect very little beyond, for example, foundations to fall as rateable within class 4 and in many cases this residual plant and machinery will be lost in the rounding of a valuation.

5.6 The exemption for the generation of renewable energy will extend to the resulting associated activities which would also fall to be rateable under class 1, including storage, transformation and transmission of power. In practice, this means that included in the exemption will be supporting equipment like transformers, dynamos, cables and conductors – in addition to items used for energy generation like solar panels.

5.7 Some plant and machinery may not be used only in relation to renewable energy. To benefit from the exemption, we propose that plant and machinery must be used for the generation, storage, transformation, or transmission of power where the source of the energy for that item of plant and machinery is wholly or mainly renewables. So, for example, if a property had 3 sources of power – a solar panel, an oil generator and the grid – the exemption would apply to those parts of the energy system which were being used wholly or mainly for the generation, storage, transformation or transmission of power from the solar panel.

5.8 The exemption for storage for EVCP will be an exemption for items falling within table 1(d)&(e) of Class 1 of the Plant and Machinery regulations where the electricity from those items is being used wholly or mainly to provide power to EVCP.

Heat network relief

5.9 In order to further support the decarbonisation of buildings, the government would like to provide rate relief to heat networks which are separately assessed and so have their own rates bill. This will take effect from 1 April 2023 and will last until 31 March 2035.

5.10 Heat networks are facilities which supply thermal energy from a central source to consumers, via a network of pipes. They range in scale and use, from a common heating system in a multi-occupied building to large units generating heat as well as power across a large area to many customers and buildings. For many of these facilities, the heat networks form part of the services to the property and do not give rise to a separate assessment for business rates, and therefore these properties do not tend to have higher rates bills compared to those with conventional heating. However, some heat networks – typically larger networks run as a separate business – may be separately assessed and have their own rates bill.

5.11 The government considers that providing relief to low carbon heat networks which have their own rates bill can help encourage the transition away from fossil fuels and support the UK’s net zero commitments.

5.12 We propose to target the relief according to the following criteria:

- The property should be wholly or mainly used as a heat network. The government wishes to provide 100% relief to those heat networks which have their own rating assessment. Broadly speaking this is where the heat network is in a separate occupation to the buildings or customers it serves.

- Only facilities which provide more thermal energy than electricity should qualify. This will ensure that facilities which by their nature are electricity power stations rather than heat networks do not qualify. To guarantee that the approach consistently supports decarbonisation goals, the test will also ensure that in considering whether the facility is providing more electricity than heat, heat being provided to an industrial process should be disregarded.

- The thermal energy should be generated from a low carbon source. This is an important part of ensuring the policy supports decarbonisation. The government is considering as part of its work on the Green Heat Network Fund the definition of low carbon sources and will work with the sector and local government to identify a methodology under which those principles can be easily and clearly applied to a relief delivered by local government.

Consultation questions – Chapter 5

Q16. Do you agree that the proposed changes to the plant and machinery regulations would ensure that plant and machinery used in onsite renewable energy generation and storage used with electric vehicles charging points are exempt?

Q17. Do you agree that the tests we are proposing in the heat networks relief scheme will ensure the relief is correctly targeted?

Chapter 6: Other administrative reforms

Introduction

6.1 The government also wishes to make a number of administrative reforms to improve the operation of the rating system for its users. This chapter details our proposals.

Reforms to the administration of the central list

6.2 Business rates are primarily a locally based property tax. Hereditaments (units of properties meriting a rating assessment) appear on the local rating list in the area in which they are located and hereditaments which cross more than one billing authority area appear in the list which it appears to the Valuation Officer contains the largest part by value. However, some properties are by their nature unsuitable for including in local lists - in particular utility networks which span many local areas and are more regional or national in nature than local. These properties are assessed to a central rating list held by the Secretary of State. The central rating list can be viewed on Gov.uk. Hereditaments appearing on the central rating list do not appear on local rating lists. The business rates bill for central list hereditaments is paid to the Secretary of State and then passed to the Treasury[footnote 3].

Current system

6.3 Currently the designation of ratepayers and descriptions of properties onto the central rating list is done by statutory instrument. The VOA may move properties in and out of the central list if they fall in (or out) of existing central list descriptions and they may also amend ratepayers’ names in the case of simple name changes (i.e. where the legal identity of the ratepayer has not changed). But in other instances, a statutory instrument is required for every change including:

a. asset sales of properties on the central list. Where the assets of a company appearing on the central list are transferred from one company to another then the name of the new company needs to be added to the central list.

b. new companies joining the list, for example where a telecom fibre network has grown into a national network meriting assessment on the central rating list.

c. reorganisations and splits of central list companies where a new company is created which is not designated.